Ireland Online Gambling Tax

Ireland’s plan to impose a one-percent tax on bets made online or over the phone from customers based in the country has been delayed into 2015, according to reporting from Reuters.

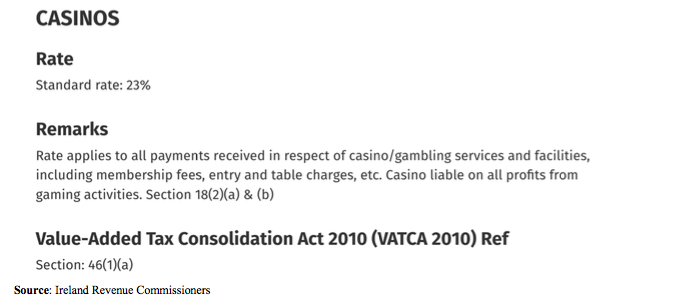

- Ireland Online Gambling Tax Rates

- Ireland Online Gambling Taxes

- Ireland Online Gambling Tax Credit

- Ireland Online Gambling Tax Rate

The country has been eyeing extending the tax to the online space since 2011.

According to the report, the delay is seen as a small win for online bookmakers like Paddy Power. The report said that the change has been delayed because Malta “raised concerns over the licensing laws for operators who are already licensed by another jurisdiction.”

“As soon as the standstill period is completed, it is my intention to progress all remaining stages of the Bill through the Oireachtas (parliament),” Finance Minister Michael Noonan said in a parliamentary reply to an opposition spokesman that was published on Sunday.

Paschal Donohoe said that it was “timely” to increase the current 1 per cent rate levied on all bets placed in the Republic of Ireland to 2 per cent for all bookmakers. Bookies face a doubling of.

Nearby London reportedly is also about to close a loophole that currently allows firms to minimize tax bills on online earnings by basing their operations offshore.

BETS PLACED BY Irish punters online will soon be taxed after laws that have taken over four years to be drafted are nearly complete.

There is a big difference in taxation in terms of trading and recreational gambling. Let’s discuss if your gambling rewards are taxable in Ireland. It’s a given that your winnings from lotteries and sports betting are not subject to Ireland’s capital gains tax. It’s good news for gambling aficionados and casino enthusiasts. The newly formed Irish Government has indicated in its 'Programme for Government 2020' that it intends to 'establish a gambling regulator focused on public safety and wellbeing, covering gambling online and in person and the powers to regulate advertising, gambling websites and apps', which could result in the implementation of some of the. Online casino Ireland. That’s why Ireland is referred to as a tax haven. After impressive growth numbers, 7 percent between 2001 and 2004, and 10 percent. A new online betting tax that has been introduced in the Republic of Ireland is set to raise an additional €25 million ($31.6 million) per year for the country.

Four years ago, Finance Minister Michael Noonan proposed a 1% tax on online gambling but the subsequent Betting Amendment Bill was significantly held up in Europe.

The problems centred on how to tax bets placed by people in Ireland using bookies based overseas and other issues relating to prosecution and enforcement.

Among the problems, the European Commission had concerns that the bill would affect the freedom of people in the Republic to place a bet with operators outside the jurisdiction.

It is estimated that €5 billion worth of bets have been placed by Irish gamblers online since 2012.

Speaking in the Dáil last week in response to a question from Fianna Fáil’s Michael McGrath, Noonan says the bill will enter committee stage in the Seanad this week.

“The standstill period has now ended and Committee Stage is provisionally scheduled for the Seanad on 11 February,” Noonan said, adding that the duty would be applied “as soon as possible once the legislation has been enacted”.

Ireland Online Gambling Tax Rates

The delay forced part of the Betting Amendment Bill to be removed and enacted as part of the Finance Bill last year. This provision saw bookmakers allowed to remain open until 10pm in the winter, reversing rules that came into force in 1931.

This change was welcomed by McGrath, who said it, along with the online duty, are both vital to allow bookie shops compete with online providers: