Pa State Income Tax Gambling Winnings

- Pa State Income Tax Gambling Winnings 2019

- Pa State Income Tax Gambling Winnings Tax

- Pa State Income Tax Gambling Winnings Losses

Another Month, Another Sports Bet Record in NJ: $931M in Nov

“Taxpayers can deduct gambling losses only up to the amount of their gambling winnings,” says Leddy, “and only if they itemize their deductions.” For example, if your gambling winnings totaled $5,000 in the tax year, but you lost $6,000, you can only deduct $5,000 of those losses. I'm having an issue with my 2016 taxes. Originally turbo tax calculated that I owed Ohio approximately $8,000 because of my gambling winnings in Indiana. At the time I was unable to pay for a second state and open a Indiana return. After updating my software yesterday and going to amend my taxes now TurboTax says they don't think I need to file a Indiana return and that I owe Ohio 6000. Line 8 - Gambling and Lottery Winnings. PA law imposes its income tax on PA residents on all gambling and lottery winnings from any source, except prizes from playing the Pennsylvania State Lottery. As a PA resident, you must include lottery winnings from other states and countries.

New Jersey gamblers wagered more than $931 million on sports in November, the latest in a string of monthly records set by a rapidly growing market that's closing in on the $1 billion-a-month mark.

Hard Rock Casino Goes Digital

Hard Rock International (HRI), a global leader in hospitality and entertainment, today announced the launch of Hard Rock Digital as part of its ongoing commitment to innovation and diversification of its portfolio in high-growth markets. Hard Rock Digital is a joint venture with gaming industry veterans, and will be the exclusive Hard Rock and Seminole Gaming (SGA) vehicle for interactive gaming and sports betting, globally.

Ayre Offers His Online Gambling, Crypto Predictions for 2021 as Bitcoin Price Skyrockets

Internet entrepreneur and billionaire Calvin Ayre took a moment to sit down and offer his predictions for the online gambling and crypto space as we are about to enter 2021 and depart from what few would argue against was the worst year ever. Well, maybe not for Bitcoin. That digital currency was sitting just below its all time high at $19250 as this was going to press.

GOP Mega Donor, Casino Billionaire Sheldon Adelson Pushes for Casinos in Texas

Texas currently has just one casino that only offers electronic gaming machines

Tennis Line Judge Rocher Banned for Betting on Matches

Tennis line judge David Rocher was banned for 18 months on Wednesday, with four months suspended, for betting on matches.

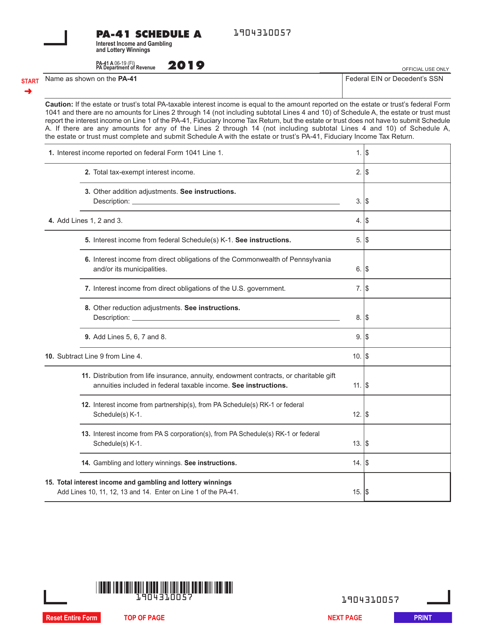

It appears you don't have a PDF plugin for this browser. Please use the link below to download 2019-pennsylvania-form-pa-40-t.pdf, and you can print it directly from your computer.

More about the Pennsylvania Form PA-40 TIndividual Income TaxTY 2019

We last updated the PA Schedule T - Gambling and Lottery Winnings in January 2020,so this is the latest version of Form PA-40 T, fully updated for tax year 2019. You can download or print current or past-year PDFs of Form PA-40 T directly from TaxFormFinder.You can print other Pennsylvania tax forms here.

eFile your Pennsylvania tax return now

eFiling is easier, faster, and safer than filling out paper tax forms. File your Pennsylvania and Federal tax returns online with TurboTax in minutes. FREE for simple returns, with discounts available for TaxFormFinder users!

File Now with TurboTaxRelated Pennsylvania Individual Income Tax Forms:

TaxFormFinder has an additional 174 Pennsylvania income tax forms that you may need, plus all federal income tax forms.These related forms may also be needed with the Pennsylvania Form PA-40 T.

| Form Code | Form Name |

|---|---|

| Form PA-40 | Pennsylvania Income Tax ReturnTax Return |

| Form PA-40 PA-V | PA-40 Payment VoucherVoucher |

| Form PA-40 W-2S | PA Schedule W-2S - Wage Statement Summary |

| PA-40 | Income Tax Return Tax Return |

| Form PA-40 A | PA Schedule A - Interest Income |

| Form PA-40 SP | PA Schedule SP - Special Tax Forgiveness |

| Form PA-40 B | PA Schedule B - Dividend Income |

| Form PA-40 UE | PA Schedule UE - Allowable Employee Business Expenses |

| Form PA-40 C | PA Schedule C - Profit or Loss From Business or Profession |

| Form PA-40 ESR-I | Declaration of Estimated TaxEstimated |

Form Sources:

Pennsylvania usually releases forms for the current tax year between January and April.We last updated Pennsylvania Form PA-40 T from the Department of Revenue in January 2020.

- Original Form PDF is https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PIT/Documents/2019/2019_pa-40t.pdf

- Pennsylvania Income Tax Forms at http://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PIT/Pages/default.aspx

- Pennsylvania Department of Revenue at http://www.revenue.state.pa.us/

About the Individual Income Tax

The IRS and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments.

Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms!

Historical Past-Year Versions of Pennsylvania Form PA-40 T

We have a total of six past-year versions of Form PA-40 T in the TaxFormFinder archives, including for the previous tax year. Download past year versions of this tax form as PDFs here:

2019

Form PA-40 T

Form PA-40 T

2019 PA Schedule T - Gambling and Lottery Winnings (PA-40 T)

2018 Form PA-40 T2018 PA Schedule T - Gambling and Lottery Winnings (PA-40 T)

2017 Form PA-40 T

2017 PA Schedule T - Gambling and Lottery Winnings (PA-40 T)

2016 Form PA-40 T2016 PA Schedule T - Gambling and Lottery Winnings (PA-40 T)

Pa State Income Tax Gambling Winnings 2019

2015 Form PA-40 T2015 PA Schedule T - Gambling and Lottery Winnings (PA-40 T)

2014 Form PA-40 T2014 PA Schedule T - Gambling and Lottery Winnings (PA-40 T)

Pa State Income Tax Gambling Winnings Tax

TaxFormFinder Disclaimer:

Pa State Income Tax Gambling Winnings Losses

While we do our best to keep our list of Pennsylvania Income Tax Forms up to date and complete, we cannot be held liable for errors or omissions. Is the form on this page out-of-date or not working? Please let us know and we will fix it ASAP.